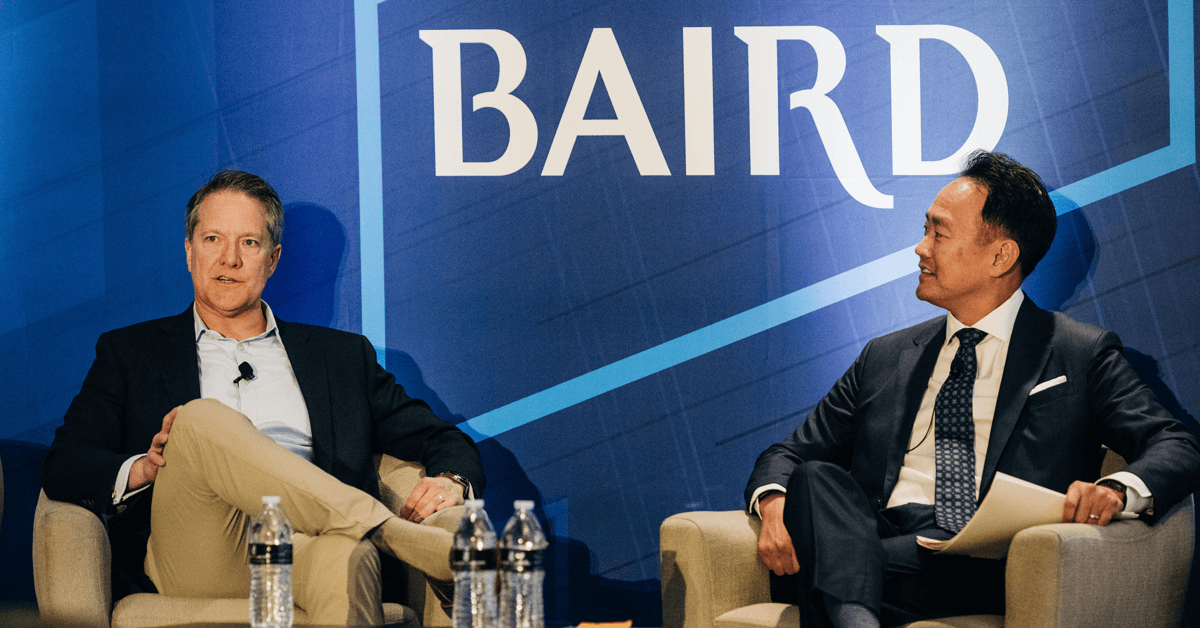

Scott McIntyre is a big believer in culture and the more intangible foundations that power a company. The Guidehouse CEO and eight-time Wash100 Award winner says that some commentators and statisticians have “lots of data” to back up the idea that “the new dynamic of selling isn’t relationship-building, it isn’t quality, it’s these other things,” but McIntyre is convinced that Guidehouse’s commitment to perhaps “old school” values is what sets it apart from other organizations in the consulting industry.

This means “being super close to your clients and understanding their needs; having a deep, deep, deep understanding of their industry, industry economics, the architecture of their businesses; and being able to position yourself for things you can actually deliver with impact and not stretch yourself into a value proposition that’s not realistic,” McIntyre relayed to fellow Wash100 recipient John Song of Baird in a fireside chat at the latter company’s 2024 Defense & Government Conference on Thursday.

M&A Culture

McIntyre also communicated that developing the culture of mergers and acquisitions is extremely critical to a successful enterprise. Guidehouse was carved out of the public sector franchise of PricewaterhouseCoopers in 2018 by Veritas Capital, so M&A is part of its origin story. It then grew largely organically, through an internal deepening of skills and offerings, under Veritas’ ownership for five years, before being purchased by Bain Capital in late 2023 for $5.3 billion.

The Guidehouse chief executive said that Bain is taking a more “strategic” approach to how it runs things than Veritas did, using it as a platform for acquisitions, building on it by buying more companies. Which is why being cognizant of the cultural ramifications of an M&A deal is “very important,” McIntyre said.

“I don’t think anybody ignores it,” he said of M&A culture, “But not everybody pays as much attention to it.” Addressing the initial split from PwC, he noted, “Our concern was we needed commercial leaders and, by extension, their staff, to really want an integrated government and commercial footprint in our core government business—healthcare, financial services, infrastructure.”

“And we did pass through a number of commercial acquisitions … Some of them … wanted to be siloed, they used that word. They wanted to do stuff, do their own thing, not change, didn’t see the value of the government. We convinced our government people the value of commercial and reciprocity in terms of a cultural dynamic that appreciate one another,” McIntyre continued.

Limitations of Inorganic Growth

At the same time, the company leader is aware of the ease with which M&A deals can become a “crutch and replace organic growth.”

“When you have access to capital and you’re very creditworthy and we have enormous cash flow in our business, it would be easy to focus more on inorganic growth and organic growth. And I think in the short run, that’s probably okay. In the long run, I don’t think it builds a great business,” he told Song.

Targeted Organic Growth

In terms of organic growth goals going forward, Guidehouse is placing “some enormous bets” on artificial intelligence over the next three years—to the point that personnel have apparently referred to McIntyre as “the AI CEO.” He revealed that their 36-month, “nine-digit investment” will include a focus on making sure “carbon-based consultants…utilize tools and introduce those tools in a cost-reducing, time-cutting measure.”

In the end, “surround yourself with people better than you and pay them well and great things happen,” McIntyre advised.