The GovCon market is facing some degree of uncertainty as the presidential election approaches and a continuing resolution puts a pause on funding growth. But one thing GovCon leaders know for certain is that the defense and government markets are rife with opportunities and poised for significant growth.

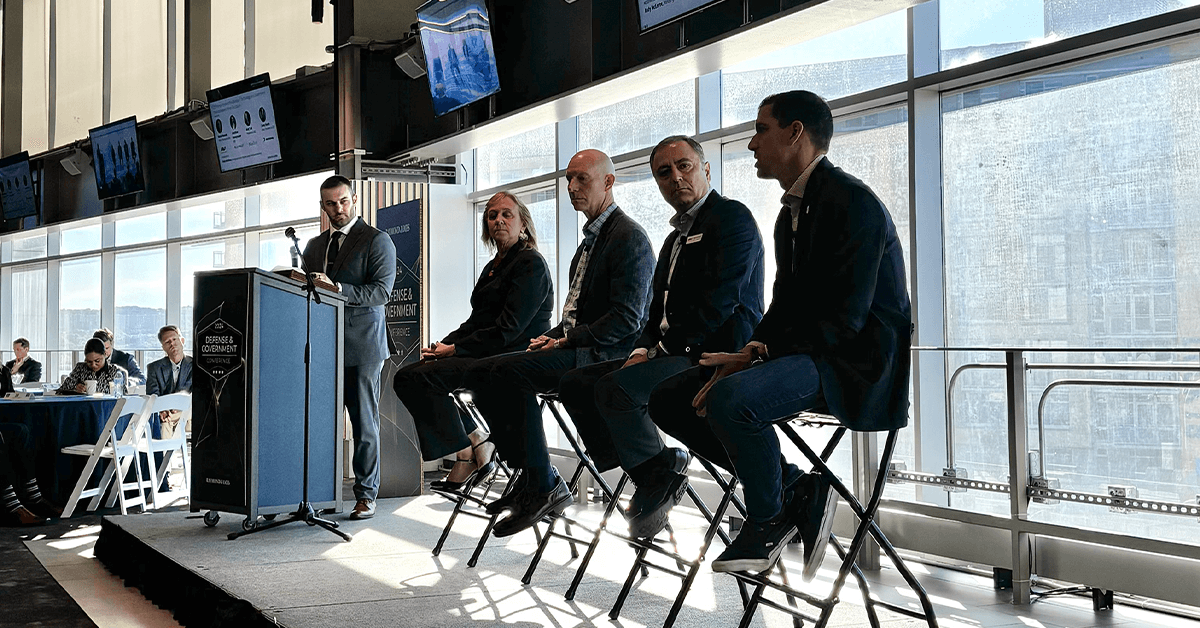

At the Raymond James 2024 Defense and Government Conference, CEOs from some of the most powerful players in the GovCon space shared their thoughts on an AI-powered future, the 2025 market outlook, the complex geopolitical environment and more in a panel discussion led by Andy McEnroe, a managing director in the defense and government services investment banking group at Raymond James.

Curious about the future of defense technology? Don’t miss the 2025 Defense R&D Summit hosted by the Potomac Officers Club on Jan. 23. Government decision makers, defense experts and industry leaders will converge to discuss what lies ahead for defense at this can’t-miss event. Join the conversation at the 2025 Defense R&D Summit.

How Government Contractors Are Approaching AI

Artificial intelligence has seen a major boom in the last couple of years, catalyzed by significant advancements in the generative AI field. Today, GovCon leaders believe AI will become as ubiquitous across the public and private sectors as technologies like cell phones and the internet.

For Parsons CEO, Chair and President Carey Smith, AI and machine learning are deeply embedded in the organization. Externally, Parsons is using AI in use cases like traffic management and energy response management. And on the federal side, the company is harnessing AI in counter unmanned air systems and cybersecurity. Smith, a six-time Wash100 Award winner, also illustrated some internal use cases.

“We apply [AI] for example to proposal management,” Smith explained. “We’re using it to determine if we’re going to win or lose a job — by the way, it has 92 percent accuracy on that. We apply it to cash forecast. We’ve trained our workforce, all 19,000 employees are going to be trained in AI. So for us, I just say it’s ingrained.”

AI has long been ingrained in companies like ManTech too. Matt Tait, ManTech CEO and two-time Wash100 Award winner, explained how the company is making AI progress with its customers.

“AI is not a new area at all for ManTech,” Tait told GovCon Wire. “We’ve been providing sophisticated AI for government clients for more than a decade, providing neural networks, machine learning and other AI approaches for the Intelligence Community. And this year we are applying AI for the U.S. Air Force, where we will modernize and simplify HR systems that currently serve half a million service men and women, as well as retirees. At ManTech we look at the combination of technologies — AI-informed Cyber, Intelligent Systems Engineering, Digital Transformation — creating force multipliers that make the difference for our clients’ mission outcomes.

AI & Unmanned Systems In Defense

Companies like AeroVironment are using AI to power drones, making some defense missions much faster and more efficient, according to CEO, Chairman and President Wahid Nawabi.

“We have the technology today that we can put on one of our drones… to say, ‘Just go in this direction, go out 100 miles and find this particular target.’ It will go 100 plus miles, and it’ll find that target with more confidence and fidelity than five humans combined, even 50 humans combined in terms of the ability to actually search an area,” said Nawabi.

“It’s tested, it is valid, I have seen it with my own eyes. That has an enormous value to our national security. If we don’t do it, our competitors will,” he warned.

By and large, the defense landscape is embracing drones as a means to project power and combat the tyranny of time and distance in critical theaters around the world. GovCon leaders see unmanned systems as the future of defense — the looming question is: Can the U.S. embrace them fast enough?

“The biggest lesson learned in Ukraine is that while you always will have room and need for these big assets, a certain percentage and portion of our national defense budget has to shift towards uncrewed systems that are interconnected at the edge of the battlefield,” said Nawabi.

“The war in Ukraine is a very, very distributed war. I call it an intelligent distributed warfare of robotic systems,” added Nawabi. “Ground robots, air robots, water robots, space robots — they have to work together with AI and autonomy for them to actually make maneuvers and strategic decisions on the battlefield with much, much smaller forces. That fundamental shift is happening across the entire globe. Every military in the world is going to shift to some extent.”

AI Regulation In GovCon

AI is still somewhat nascent, and the federal government is trying to wrap its arms around how to approach it from a policy and regulatory perspective. But GovCon leaders agree that too much regulation could be a bad thing.

“What does that regulation look like? Should there be regulation? How does your business prepare for that?” asked Tait. “I would say we believe that there should be some regulation, and it should be standards-based, and it should be agreed upon by the government as well as private industry.”

For BlueHalo CEO Jonathan Moneymaker, another Wash100 Award winner, that regulation will need to take into consideration a variety of different use cases, from internal optimization to weapons systems on the battlefield.

“I agree with the standard-based approach. I think the application is critically important,” said Moneymaker. “Looking at AI from an internal standpoint versus a combat scenario are two very different things. And we need to, I think, figure out what the right level of policy [is].”

GovCon Market Outlook Going Into 2025

Continuing Resolutions

Congress passed a stopgap bill on Sep. 25, averting a government shutdown but perpetuating budget uncertainty for fiscal year 2025. The way GovCon CEOs approach continuing resolutions, or CRs, slightly differs — some say CRs are expected and they’ve learned to adapt, while others say that’s not how contractors should have to operate. Either way, all agree that they’re harmful to the industry and the country as a whole.

“We need Congress to do their job,” said Tait. “No new starts in defense. This is giving our adversaries an advantage, and we should not allow that as a country.”

M&A Outlook

Even with the uncertainty of a looming presidential election, government contractors have remained active in pursuing organic and inorganic growth. Raymond James reported that Q2 of 2024 saw 122 GovCon M&A deals — a 63 percent increase from the prior year period. Parsons, for example, has signaled that it plans to make a couple more deals this year.

“We’ve bought 12 companies in the last six years, and we’ve indicated this year we’ll do at least three deals. We’ve already made one so far this year,” said Smith.

Parsons bought BlackSignal Technologies for $200 million earlier this year, broadening the company’s reach in AI, cybersecurity and electronic warfare.

Growth Priorities

For BlueHalo and Moneymaker, scaling is the major focus for their next phase of growth.

“How do we now take these systems that have been introduced in a disruptive manner into the force? How do we now deploy them at scale? So a tremendous amount of investment over the last couple years around scaling our manufacturing,” he said.

Tait shared that ManTech is laser-focused on national security and on the combination of the company’s capabilities. The growth they anticipate will be in their core areas and with their key customers like the Department of Defense and the Intelligence Community.

Nawabi highlighted the importance of independent research and development, or IRAD, in AeroVironment’s growth strategy.

“I’ve been with the company for 15 years, and I’ve never had a year that we haven’t invested less than 10 percent in IRAD,” Nawabi said. “We invest a lot in R&D as a company. It’s over $200 million a year in this category, and it’s all based on robotic systems.”