Global investment firm Carlyle (Nasdaq: CG) has agreed to acquire ManTech International (Nasdaq: MANT) in an all-cash transaction worth approximately $4.2 billion.

ManTech’s board of directors unanimously approved the transaction that is expected to conclude in the second half of calendar year 2022, subject to ManTech shareholders’ approval, regulatory clearances and other customary closing conditions, the companies said in a joint release published Monday.

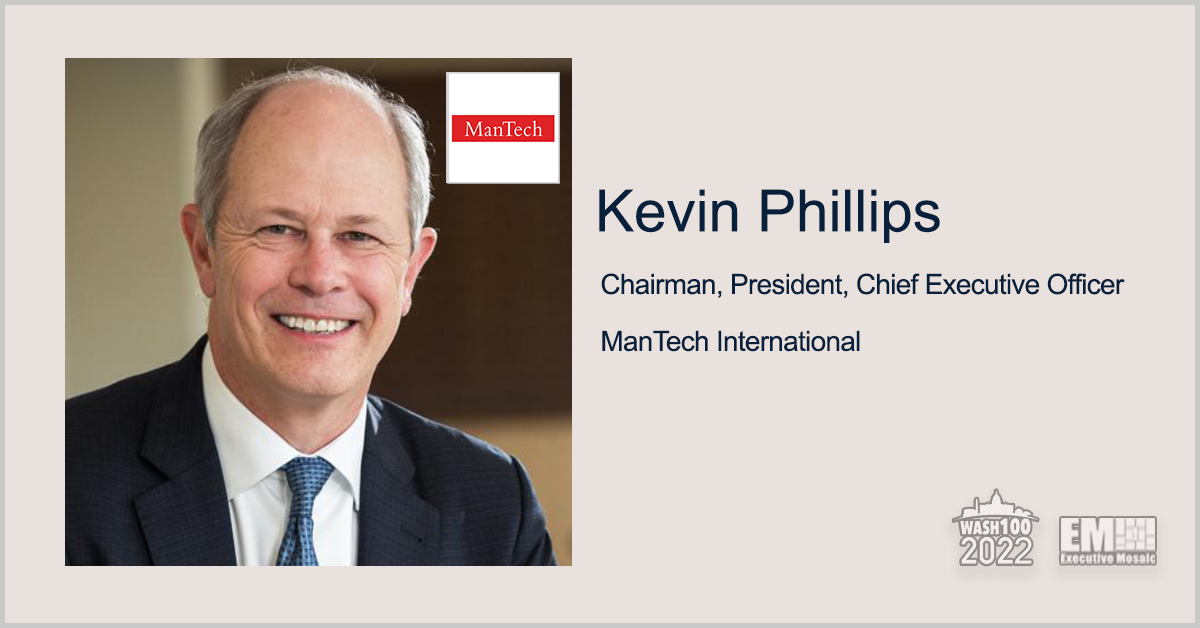

“Following a comprehensive review of strategic alternatives, our Board determined that this transaction is in the best interest of our shareholders and provides them with the most compelling value maximization outcome, offering liquidity at a significant premium,” said Kevin Phillips, chairman, president and CEO of ManTech.

“We look forward to leveraging Carlyle’s deep knowledge and experience investing in and growing companies, as we deliver stronger outcomes for our customers and increased opportunities for our employees,” added Phillips, a 2022 Wash100 Award winner.

ManTech shareholders would get $96 a share in cash, which reflects a 17 percent premium to the defense contractor’s closing stock price of $81.97 Friday, May 13, and a 32 percent premium to the unaffected closing share price of $72.82 on Feb. 2.

Stockholders holding shares representing 49.2 percent of the current outstanding voting power of the ManTech common stock agreed to vote their shares of common stock in favor of the deal.

Robert W. Baird & Co. is serving as financial adviser and Latham & Watkins is acting as legal adviser to Carlyle on the transaction.

Goldman Sachs & Co. and King & Spalding serve as exclusive financial adviser and legal counsel, respectively, to ManTech.