Kim Koster, vice president of GovCon Strategy at Unanet, co-author of the 2020 GAUGE Report and GovCon Expert, has published her latest article as a member of Executive Mosaic’s GovCon Expert program on Thursday. GovCon Expert Koster explains how in the current financial climate, a few upgrades to labor, billing processes and capabilities can loosen cash constraints and bolster profitability for the federal market.

You can read Kim Koster’s latest GovCon Expert article below:

Looking to Lift Cash Flow? Try Tightening SubK Management

By Kim Koster

Hidden amid all the tumult that government contractors have endured here in 2020 is a golden opportunity.

The combination of pandemic, economic upheaval, regulatory uncertainty, and other business pressures has given government contractors an opportunity — and plenty of motivation — to explore ways to make their businesses more efficient and data-intelligent. Ultimately, it’s a chance for contractors to look inwardly for ways to build their competitive edge. And subcontractor management is among the prime targets for improvement.

By tightening the processes around subcontractor labor and billing, government contractors not only can improve cash flow but can give themselves a better chance of delivering projects on time and on- or under-budget. The government contracting sector as a whole needs to continue to focus on overall project execution, according to the recently released 2020 GAUGE Report from Unanet and CohnReznick, because there’s still room for individual companies to competitively differentiate themselves by becoming even more efficient in how they manage projects — and the subcontractors who work on those projects.

Drawing on survey responses from government contractors across the United States, the report reveals that:

59% of contractors say their projects come in on or under budget 75% to 100% of the time.

65% of contractors say 75% to 100% or their projects are completed on time.

The competitive edge that comes from stronger subcontractor management is largely a function of improved enterprise resource planning (ERP) processes and capabilities. As noted in the 2020 GAUGE Report, “By this point, most government contractors use technology to help run their businesses. However, only a few are using it to run their businesses better. What is the difference? One automates a work step, the other improves efficiencies. Winning firms are doing more of the latter, leveraging technology solutions to elevate their businesses.”

Simply by automating the timekeeping process, for example, a prime contractor can shave minutes off each employees’ time entry task, and hours off of the task of billing subcontractors.

Time savings are just one way improved subcontractor management can benefit government contractors. Here’s a look at several others:

1. Increased cash flow. With disparate systems, it takes six to eight weeks to turn subcontractor labor into revenue and/or cash. However, with ERP capabilities that enable subcontractors to track time and expense in the prime contractor’s system, the billing process can be significantly shortened, enabling both the prime contractor and the subcontractor to decrease DSO (days sales outstanding), which in turn enables them to recognize revenue faster.

2. Better project execution as a result of heightened visibility into subcontractor cost/time. Too often, project managers find themselves flying blind, with very little day-to-day visibility into subcontractor time and cost while a project is ongoing. When a prime contractor has full 360° visibility into time and cost, however, they gain a new level of control over a project as it is unfolding. Real-time insight into utilization, resources, funding, cash, revenue, and profit leads to tighter execution and generally better project outcomes across the board.

3. No more accounting accrual nightmares. Instead of continuing to rely on unwieldy manual processes, journal entries, and lengthy reconciliations just to understand cost and create a bill, contractors can make life a lot simpler for their accounting departments by upgrading and automating how they manage the flow of that information.

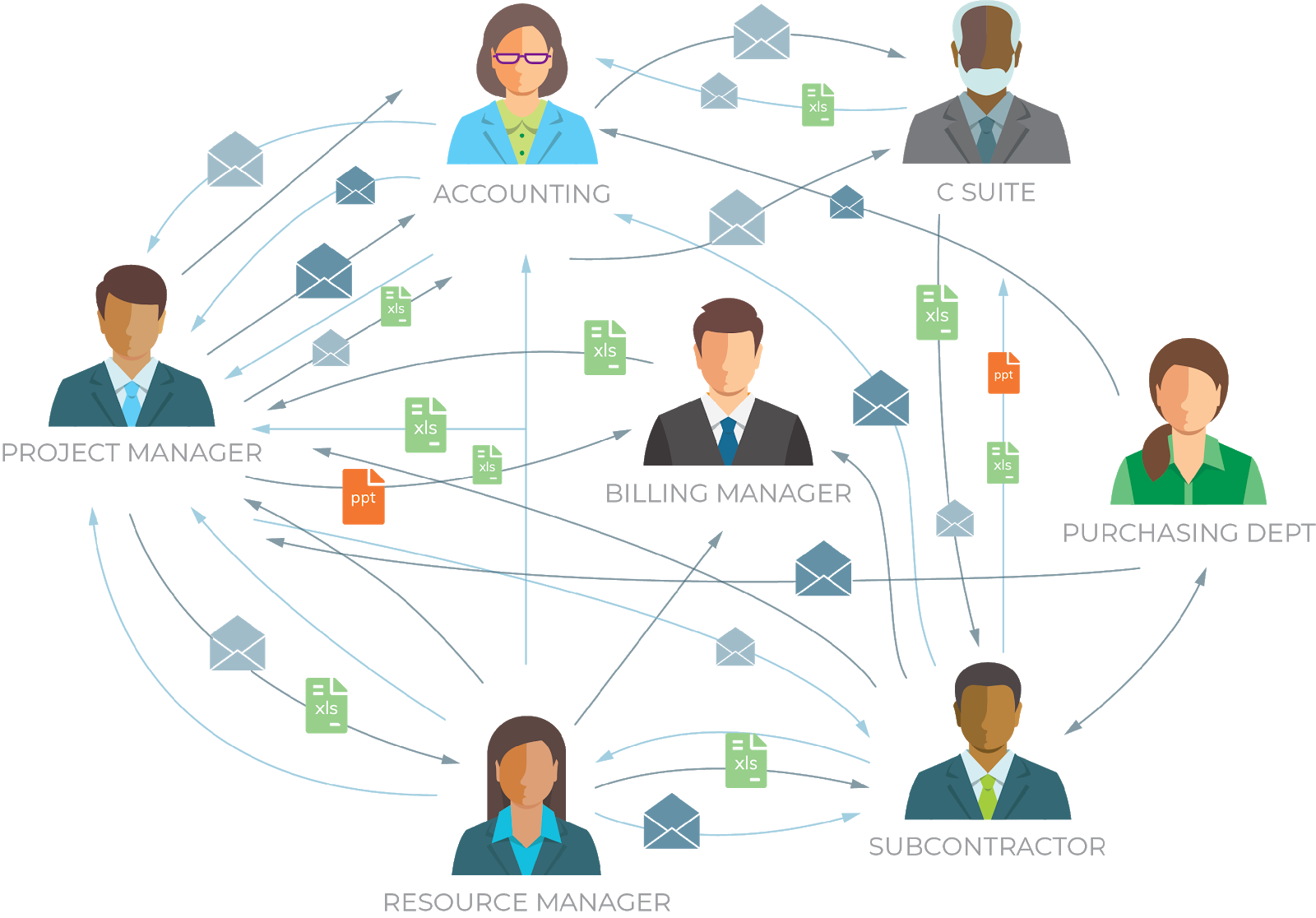

4. Relief from email chaos and redundant data entry. If your firm does business with, say, 100 subcontractors that have an average of 10 employees each, that’s potentially 1,000 employees for which your accounting department has to traffic time sheets, expense reports, etc. — and oftentimes, do so from multiple disparate systems. This approach to time-collection and subcontractor management is time-consuming, costly, and, frankly, mind-numbing for the people that perform it. Here again, relief comes by enabling subcontractors to access and input their time directly into your firm’s system.

5. Greater data accuracy means fewer mischarges and inaccurate invoices. Disparate systems that rely heavily on manual data entry are error-prone, which can delay the issuance of invoices as well as the time to cash. By avoiding errors in subcontractor labor accounting, invoices are correct the first time.

6. Reduced compliance risk. From DFARS and the Department of Defense’s new Cybersecurity Maturity Model Certification (CMMC) program to incurred cost submissions (ICS) and meeting the demands of the Defense Contract Audit Agency (DCAA), government contractors have plenty on their compliance plates these days.

The CMMC, for example, specifies a wide range of new standards that apply to primary DoD contractors as well as their subcontractors. Prime contractors will need to assess their vendor risk and demonstrate/document that their subcontractors meet appropriate cybersecurity standards.

With ICS and subsequent DCAA audits, meanwhile, contractors must be able to document, among other things, vendor and subcontractor payments. When information like this flows freely in real time between a prime contractor and its subcontractors, the prime contractor should be able to readily produce this information for regulators .

7. A firm-wide boost to operational efficiency and outcomes. Focusing on subcontractor management can enable government contractors to capture operational efficiencies that readily scale across the enterprise.

By more tightly managing the key labor and billing elements of their subcontractor relationships — payroll, invoicing, project accounting, chargeback, and job cost accounting — firms can remove much of the guesswork, redundancy, delays, and risk out of those relationships, freeing them to focus on what really matters: delivering high-quality outcomes in a timely, profitable way.

Kim Koster is Vice President of GovCon Strategy for Unanet, a leader in ERP software purpose-built for government contractors. She supports GovCons in their effort to streamline project management, accounting and other businesses processes.