Executive Mosaic’s GovCon Index crawled to a fifth straight record close Friday to extend its current stretch of weekly gains to three and record a five-day advance of 2.72 percent .

Executive Mosaic’s GovCon Index crawled to a fifth straight record close Friday to extend its current stretch of weekly gains to three and record a five-day advance of 2.72 percent .

The U.S. stock benchmark S&P 500 also inched to a record close for a weekly gain of more than 1 percent despite investor uncertainty over France’s weekend presidential election and large declines among banking and energy shares.

GovCon Index decliners outnumbered advancers 17-13 and six of its 11 S&P 500 components registered gains with Huntington Ingalls Industries (NYSE: HII) the GCI’s top net performer overall for a second straight session and Boeing (NYSE: BA) the best among co-listed stocks.

On a weekly basis, 25 of the GovCon Index’s 30 stocks advanced with CAE (NYSE: CAE) the GCI’s top percentage gainer over five days.

HII’s stock continued momentum from strong fourth quarter earnings posted Thursday, while Boeing climbed after President Donald Trump’s address to a company aircraft manufacturing facility in North Charleston, S.C. that helps produce the 787 Dreamliner jet.

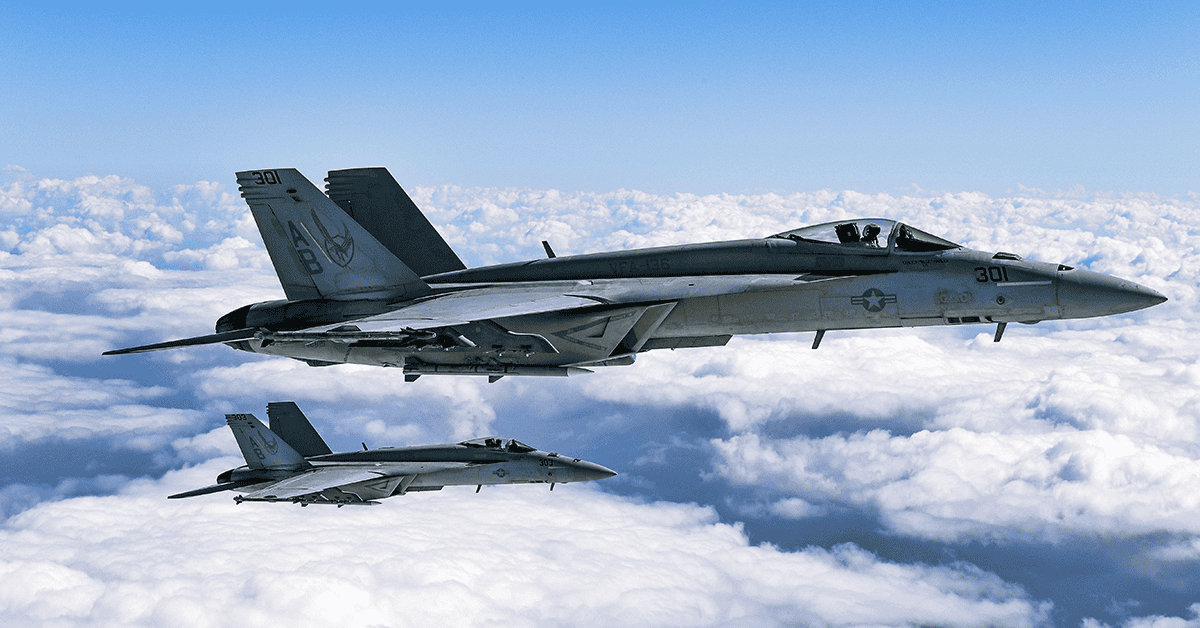

He promised in that speech to bolster U.S. manufacturing and build up the country’s military, plus said he was “seriously at a big order of Boeing F-18 Super Hornet fighter jets he has claimed could act as an alternative to Lockheed Martin‘s (NYSE: LMT) F-35.

Seven GCI stocks reached 52-week highs during the session: Boeing, Huntington Ingalls, General Dynamics (NYSE: GD), Raytheon (NYSE: RTN), Harris Corp. (NYSE: HRS), L3 Technologies (NYSE: LLL) and Cubic Corp. (NYSE: CUB).

Services-oriented contractors led decliners in the GCI: Engility Holdings (NYSE: EGL), CACI International (NYSE: CACI), KBR (NYSE: KBR), AECOM (NYSE: ACM) and Science Applications International Corp. (NYSE: SAIC).

Textron (NYSE: TXT) closed down 1.33 percent — or $0.65 — to $48.36 and ended as the largest laggard among companies listed in both the GCI and S&P 500.

Energy stocks led seven major S&P sectors lower with consumer shares the top performer among the remaining four.

Non-GovCon Index company DigitalGlobe (NYSE: DGI) closed up 18.24 percent to $35.00 and hit a new 52-week high in Friday trade after the Wall Street Journal reported the geospatial imagery provider was in talks to be acquired by Canada-based satellite company MacDonald Dettwiler & Associates.

Shares in DigitalGlobe climbed as high as 34.96 percent during the 2 p.m. Eastern time hour when the story was published.

Dana Mattioli wrote that based on “typical takeover premium,” DigitalGlobe’s estimated market value of $1.8 billion at the time of her report suggests a potential deal value of $2 billion-$3 billion.

MDA is headquartered in the Vancouver metropolitan region and in January established a U.S.-based subsidiary with headquarters in the San Francisco region that is working toward eligibility for classified space contracts with NASA, the Defense Department and intelligence agencies as part of the parent’s “U.S. Access Plan.”

MDA ended Friday at a market value of nearly $2 billion for its shares traded on U.S. over-the-counter markets.

Market Summary

| Index | Value | Net Change | % Change |

|---|---|---|---|

| GovCon Index | 92.799 | +0.032 | +0.034% |

| S&P 500 | 2,351.16 | +3.94 | +0.17% |

| Dow Jones Industrial Average | 20,624.05 | +4.28 | +0.02% |

| NASDAQ | 5,838.90 | +23.68 | +0.41% |

| Advancing GovCon Index Issues | 13 |

| Declining GovCon Index Issues | 17 |

| Unchanged GovCon Index Issues | 0 |

Top GovCon Index Net Performers

| Symbol | Company | $ Current Price | Net Change –´ | % Change |

|---|---|---|---|---|

| HII | Huntington Ingalls Industries | 211.91 | +1.97 | +0.94% |

| BA | Boeing * | 172.71 | +1.90 | +1.11% |

| MCK | McKesson Corp. * | 150.25 | +0.83 | +0.56% |

| HRS | Harris Corp. * | 109.46 | +0.81 | +0.75% |

| RTN | Raytheon * | 152.86 | +0.47 | +0.31% |

Top GovCon Index Percentage Performers

| Symbol | Company | $ Current Price | Net Change | % Change –´ |

|---|---|---|---|---|

| BA | Boeing * | 172.71 | +1.90 | +1.11% |

| HII | Huntington Ingalls Industries | 211.91 | +1.97 | +0.94% |

| CUB | Cubic Corp. | 52.50 | +0.45 | +0.86% |

| HRS | Harris Corp. * | 109.46 | +0.81 | +0.75% |

| MCK | McKesson Corp. * | 150.25 | +0.83 | +0.56% |

Lowest GovCon Index Net Performers

| Symbol | Company | $ Current Price | Net Change –¾ | % Change |

|---|---|---|---|---|

| CACI | CACI International | 126.70 | -0.90 | -0.71% |

| EGL | Engility Holdings | 31.16 | -0.89 | -2.78% |

| KBR | KBR | 16.50 | -0.73 | -4.24% |

| TXT | Textron * | 48.35 | -0.66 | -1.35% |

| ACM | AECOM | 37.75 | -0.65 | -1.69% |

Lowest GovCon Index Percentage Performers

| Symbol | Company | $ Current Price | Net Change | % Change –¾ |

|---|---|---|---|---|

| KBR | KBR | 16.50 | -0.73 | -4.24% |

| EGL | Engility Holdings | 31.16 | -0.89 | -2.78% |

| VEC | Vectrus | 23.34 | -0.59 | -2.47% |

| ACM | AECOM | 37.75 | -0.65 | -1.69% |

| TXT | Textron * | 48.35 | -0.66 | -1.35% |